Are you self-employed in Canada and feeling overwhelmed by the mortgage process? You're not alone. Navigating the mortgage maze can be challenging, but understanding alternative financing options and lender requirements can make a significant difference. Learn how to leverage professional advice to secure the best mortgage solutions tailored to your unique financial situation. Discover essential tips that can help you achieve your dream of homeownership with confidence.

Blog by yourmortgageyourway.ca

-

Navigating the Mortgage Maze: Tips for Self-Employed Canadians

Click here to read the full article »

-

Demystifying Mortgage Refinancing: A Guide for Canadian Homeowners

Unlock the potential of your home with our comprehensive guide to mortgage refinancing, specifically crafted for Canadian homeowners. Discover how you can secure better rates and consolidate debt to enhance your financial health. With tailored expert advice, learn to navigate the complexities of refinancing, ensuring your decisions align with your long-term financial goals. Empower yourself with the knowledge to make informed choices that could lead to improved financial stability and peace of mind.

Click here to read the full article »

-

Navigating the Canadian Mortgage Market: Tips for First-Time Buyers

Embarking on the journey of homeownership can be both exciting and daunting for first-time buyers in the Canadian mortgage market. Understanding the intricacies of Canada mortgages is crucial to making informed decisions that align with your financial goals. In this blog post, we delve into essential mortgage tips, providing you with the knowledge needed to navigate the complexities of the market. Discover how leveraging expert advice can help you secure the best deal and make your dream of owning a home a reality.

Click here to read the full article »

-

Understanding the Mortgage Landscape: A Comprehensive Guide for Canadian Homebuyers

Navigate the complexities of the Canadian mortgage market with our comprehensive guide designed for both first-time homebuyers and seasoned investors. This insightful article explores various mortgage types, sheds light on current interest rates, and highlights the pivotal role of mortgage brokers. By understanding these key elements, you'll be equipped to make informed financial decisions that align with your homeownership goals. Whether you're looking to secure your first home or expand your investment portfolio, this guide provides the essential knowledge you need to succeed in the dynamic world of Canadian real estate.

Click here to read the full article »

-

Navigating Mortgage Options: A Guide for Self-Employed Professionals

Are you a self-employed professional navigating the complexities of securing a mortgage? Discover the unique challenges you may face and explore the solutions specifically designed for individuals with non-traditional income. This guide delves into alternative financing options, offering insights on how to secure the best mortgage rates tailored to your unique financial situation. Gain valuable knowledge to make informed decisions and simplify the mortgage process, ensuring you achieve your homeownership dreams with confidence.

Click here to read the full article »

-

Fixed-Rate Vs. Adjustable-Rate Mortgages: Which Is Right For You?

Embarking on the journey to homeownership is a monumental decision that can enhance your life in countless ways. However, the choices you make regarding your mortgage can significantly impact your financial well-being. In this informative guide, we’ll explore the key differences between fixed-rate and adjustable-rate mortgages, two of the most common options for financing your home. As dedicated team-focused professionals serving clients across the Greater Toronto Area and all over Canada, we understand the importance of making the right mortgage decision. Join us as we navigate the world of mortgages, shedding light on the pros and cons of each type, helping you determine which one aligns best with your unique needs.

Click here to read the full article »

-

Essential Steps For First-Time Homebuyers: Your Mortgage Journey Begins

Embarking on the path to homeownership is an exciting journey that many dream of. However, for first-time homebuyers in the Greater Toronto Area and across Canada, this journey can seem overwhelming at times. As dedicated team-focused professionals committed to enhancing your life through tailored mortgage solutions, we understand the challenges you may face. In this informative guide, we’ll walk you through the essential steps for first-time homebuyers, shedding light on the intricacies of the mortgage process. Join us as we demystify the world of mortgages and help you take your first steps toward homeownership.

Click here to read the full article »

-

Top Factors That Affect Your Mortgage Interest Rate

Are you considering entering the world of homeownership? Exciting times lie ahead as you embark on the journey of purchasing your dream property in the Greater Toronto Area or anywhere else in Canada. However, before you can call that house your home, there’s a crucial factor you need to understand – your mortgage interest rate. In this comprehensive guide, we will delve deep into the top factors that affect your mortgage interest rate. Armed with this knowledge, you’ll be better equipped to make informed decisions and secure the best mortgage loan that suits your needs. Let’s dive right in!

Click here to read the full article »

-

Announcing The New Website

We are delighted to announce the launch of our new website!

Click here to read the full article »

-

New Website Under Construction

New Website Coming Soon!

Click here to read the full article »

-

Mortgage Life Insurance, Do You Need It?

Your Mortgage Your Way mortgage professionals can protect your family and your home through a mortgage life insurance policy; a life insurance policy on you, the homeowner, that will allow your family or dependents to pay off the mortgage on your home should something tragic happen to you.

Click here to read the full article »

-

Strategies To Speed Your Way To Debt-Free Homeownership

Mortgages in Canada are generally amortized over 25 to 35 year terms. Nevertheless, with a little foresight and planning, and some sacrifice, most people can manage to pay off their mortgage in a much shorter period of time.

Click here to read the full article »

-

Five Financial Considerations Before Buying a Home

Transitioning from renter to homeowner is one of the most important decisions you’ll make in your life. This decision will impact your future greatly, creating obligations and also opportunities.

Click here to read the full article »

-

Fixed Rate vs. Variable Rate: A Simple Overview

The decision to choose a fixed vs. a variable rate is not always an easy one. It depends on your tolerance for risk as well as your ability to withstand increases in mortgage payments.

Click here to read the full article »

-

Planning Ahead for Unforeseen Circumstances

In the current COVID-19 pandemic, the uncertainty of job loss is a reality for many people, planning ahead by putting mortgage payments aside while you’re still actively employed can help set your mind at ease.

Click here to read the full article »

-

Understanding Your Credit Report

As credit has become more and more common in our society, your credit report, and thus your credit rating, has become more important in your daily life.

Click here to read the full article »

-

Five Ways In Which You Can Improve Your Credit Score

Your credit score is a number between 300-900 given to you based on the repayment history of your credit facilities, such as credit cards, lines of credit and auto loans.

Click here to read the full article »

-

Why You Should Consider Having A Will

Buying a house is probably the largest investment you will ever make and it is a huge milestone in your life; something to be very proud of.

Click here to read the full article »

-

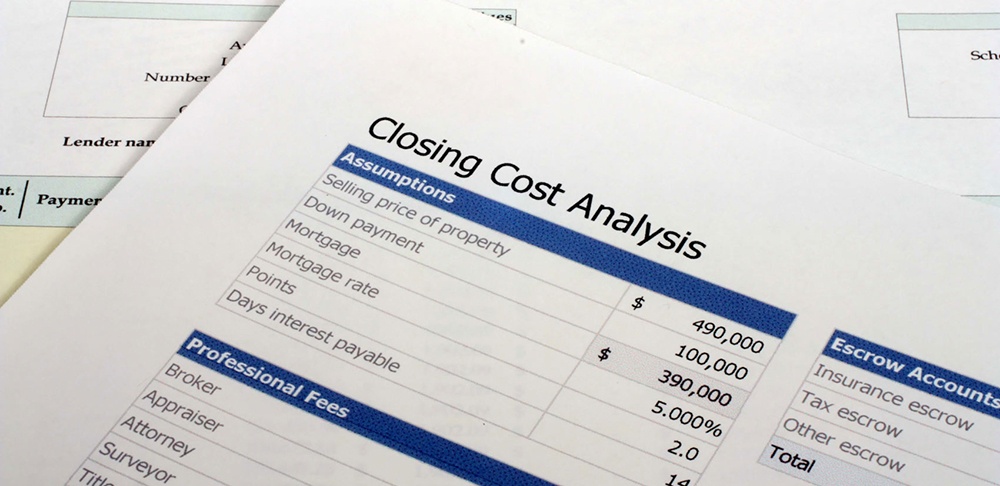

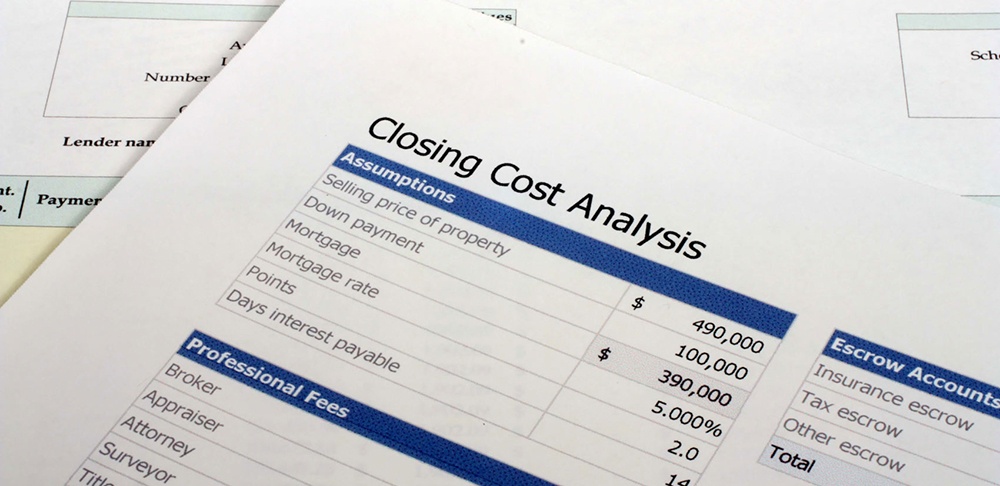

Closing Costs

It is extremely important to make sure that you consider and account for the closing costs that are associated with the purchase of your home.

Click here to read the full article »

-

Transitioning from Renter to Homeowner

Transitioning from renter to homeowner is one of the biggest decisions you’ll make throughout your lifetime.

Click here to read the full article »