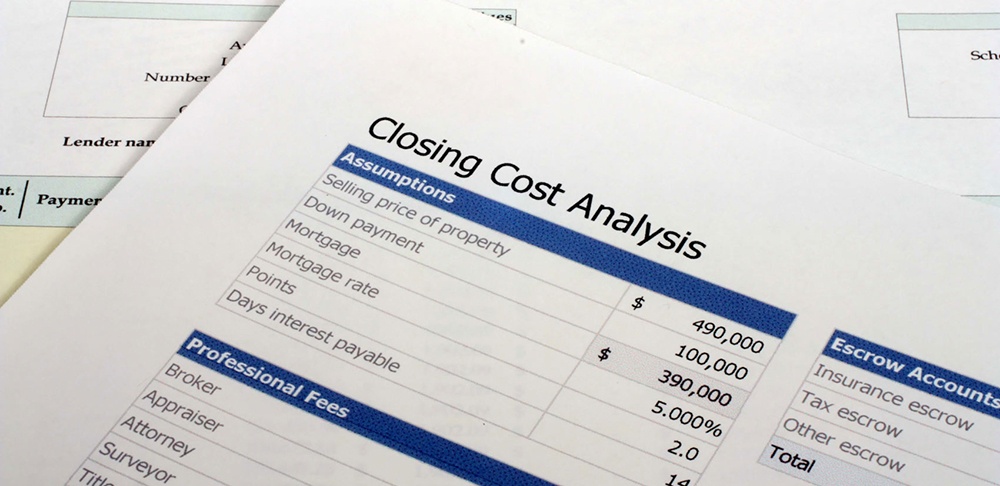

Closing Costs

It is extremely important to make sure that you consider and account for the closing costs that are associated with the purchase of your home. Closing costs are generally 1.5-3% of the purchase price. Here are some of the most common ones that you should keep in mind in order to avoid any surprises:

Home Inspection: $250-300 to make sure the home is up to code and doesn’t have any hidden problems.

Home Appraisal: $300-450 A fee charged to appraise the home value and not required on a CMHC insured mortgage. It can sometimes be covered by the lender.

Land Transfer Tax – Provincial:

- Up to $55,000 X 0.5% of total property value

- From $55,000 to $250,000 X 1% of total property value

- From $250,000 to $400,000 X 1.5% of total property value

- From $400,000 up X 2% of total property value

- First time home buyers are able to get a credit of up to $4000 on this amount.

- The City of Toronto levies an additional LTT on Toronto real estate in addition to the provincial rate.

Land Transfer Tax – Municipal

- Up to and including $55,000.00 X 0.5% of total property value

- From $55,000.01 to $400,000.00 X 1% of total property value

- Over $400,000.00 X 2% of total property value

- First time home buyers are able to get a credit of up to $4000 on this amount.

Real Estate Lawyer Fee: depends on the purchase price of your home and the lawyer.

Title Insurance: Provides coverage for the home owners rights of ownership, including fraud, forgery, missing heirs, among others. $300-500

Closing Adjustments: This is an estimate on bills the previous owner has prepaid such as property tax and utility bills.

Interest Adjustments: Payment of interest if mortgage starts in the middle of the month. On a 3% Fixed mortgage, this would be about $50 a day times the number of days

PST on CMHC Premium: Only applicable if the down payment is less than 20% of the purchase price

Status Certificate Fee: Only applicable on Condo Units: Approx. $100 one time fee

New Home Warranty: Only applicable on new builds

HST: Only applicable on new builds and Province specific

Other costs:

Property Insurance: $30-80 per month

New Hydro Account: A one time fee charged when the homeowner has never had a hydro account before: $200

Total: Would be 1.5-3% of the purchase price of your home.